คอร์สเรียน "ชนะใจสินเชื่อบ้าน ฉบับพนักงานประจำ"

โดย แต้ว ปัญแสง

กู้บ้านไม่ใช่เรื่องยาก!

มาเรียนรู้ทุกเคล็ดลับในคอร์ส

เข้าใจทุกขั้นตอนของการขอสินเชื่อบ้านสำหรับพนักงานประจำ พร้อมคำแนะนำที่เข้าใจง่าย ทำได้จริง และเพิ่มโอกาสกู้ผ่านอย่างมั่นใจ!

รายละเอียดคอร์ส

1. General Home Loan Information

- What is a home loan?

- What are the benefits of getting a home loan?

- How does the home loan process work?

- What documents are required to apply for a home loan?

- What is the difference between a fixed-rate and a variable-rate loan?

2. Eligibility & Requirements

- Who is eligible to apply for a home loan in Thailand?

- Can foreigners apply for home loans in Thailand?

- How does age affect home loan eligibility?

- What credit score is required to get a home loan?

- What employment or income documents are required?

3. Loan Application Process

- How do I apply for a home loan?

- How long does the home loan approval process take?

- What factors do banks consider when approving a home loan?

- What should I do if my loan application is rejected?

4. Loan Types & Packages

- What types of home loans are available in Thailand?

- What is a refinancing loan, and how does it work?

- What is a top-up loan, and how can I get one?

- How do I choose the right home loan package for me?

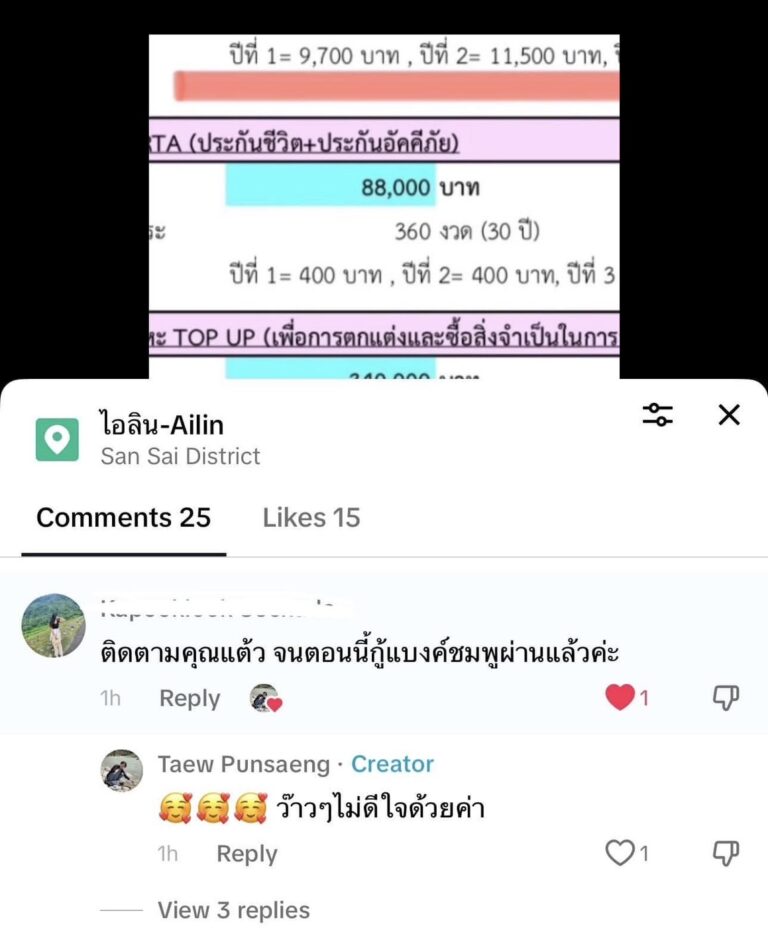

5. Loan Repayment & Interest Rates

- How are home loan interest rates calculated?

- What is the difference between effective and nominal interest rates?

- What happens if I miss a payment on my home loan?

- Can I pay off my home loan early? Are there any penalties?

6. Fees & Charges

- What are the fees associated with getting a home loan?

- Are there any fees for early repayment or refinancing?

- What are the legal and administrative costs of getting a home loan?

7. Refinancing & Debt Restructuring

- When should I consider refinancing my home loan?

- How do I apply for refinancing?

- What are the benefits of debt restructuring?

- How can I negotiate with my bank to restructure my debt?

8. Legal & Contractual Matters

- What are the key terms in a home loan contract?

- What is a mortgage contract, and how does it work?

- What should I check before signing a home loan contract?

- Can I transfer my home loan to another person or bank?

9. Property Appraisal & Valuation

- Why do banks require a property appraisal?

- How is the value of a property determined?

- What happens if the appraised value is lower than the purchase price?

10. Home Loan Consulting Services

- What services do home loan consultants provide?

- How can a home loan consultant help me?

- How do I choose the right home loan consultant?

11. Tips & Advice

- How can I increase my chances of getting a home loan?

- What common mistakes should I avoid when applying for a home loan?

- How can I improve my financial health to qualify for a better loan?

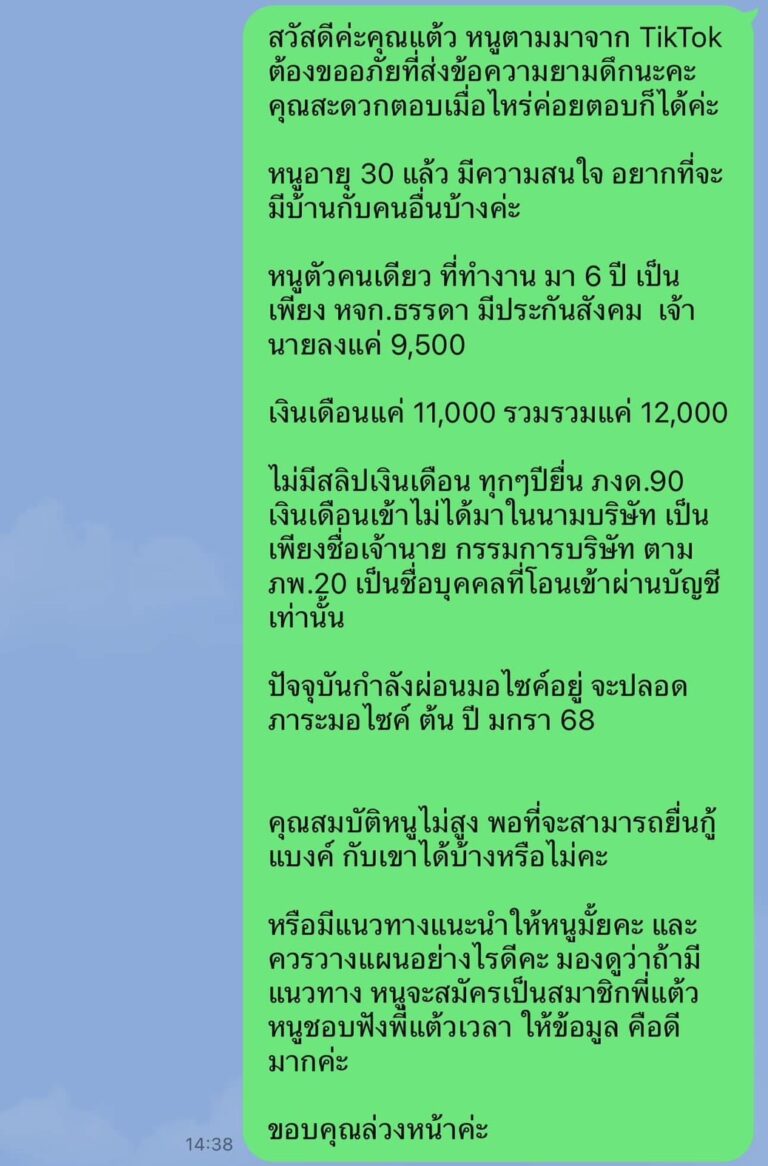

12. FAQ for Self-employed or Business Owners

- How can self-employed individuals apply for a home loan?

- What additional documents are required for business owners?

- How do I prove my income if I am self-employed?

13. For Foreigners & Non-Residents

- Can foreigners get a home loan in Thailand?

- What are the requirements for foreigners to apply for a home loan?

- Are there any special regulations for foreigners buying property in Thailand?

14. Loan Troubleshooting & Support

- What should I do if I can’t repay my home loan?

- How do I contact customer service for help with my home loan?

- Can I pause my loan payments in case of financial hardship?

ชนะใจสินเชื่อบ้าน ฉบับพนักงานประจำ

คำถามยอดนิยม (FAQ)

Q: คอร์สนี้เหมาะกับใคร?

A: คอร์สนี้เหมาะสำหรับพนักงานประจำทุกคนที่ต้องการซื้อบ้าน และต้องการเพิ่มโอกาสในการขอสินเชื่อผ่าน

Q: ต้องมีพื้นฐานความรู้เกี่ยวกับสินเชื่อไหม?

A: ไม่จำเป็นเลย! คอร์สนี้ออกแบบมาเพื่อผู้ที่ไม่มีพื้นฐาน

Q: เรียนได้ที่ไหน?

A: คุณสามารถเรียนได้ผ่านคอมพิวเตอร์หรือมือถือ ทุกที่ทุกเวลา

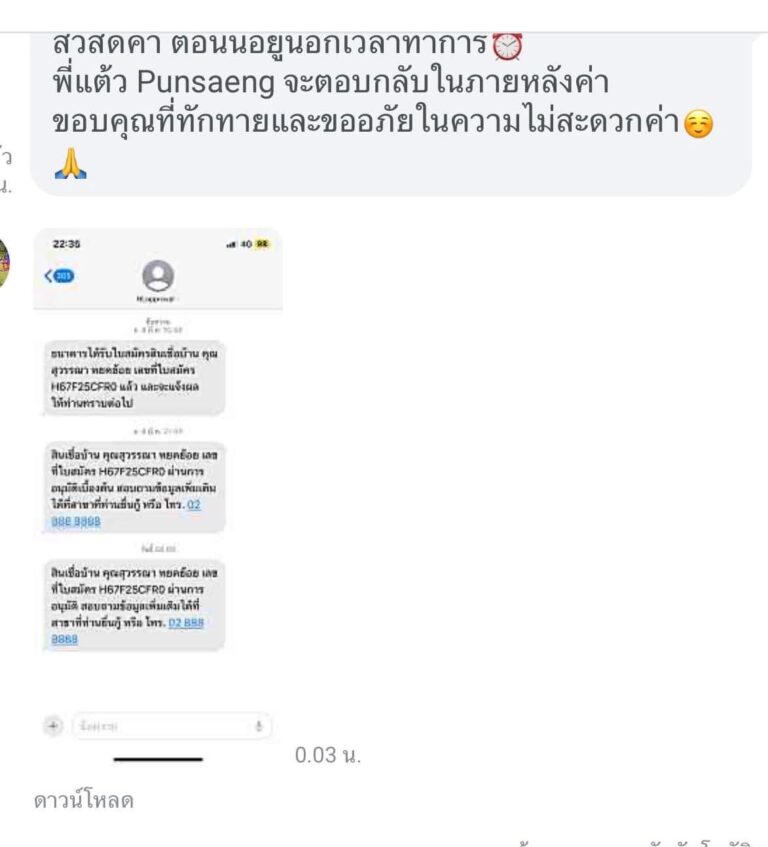

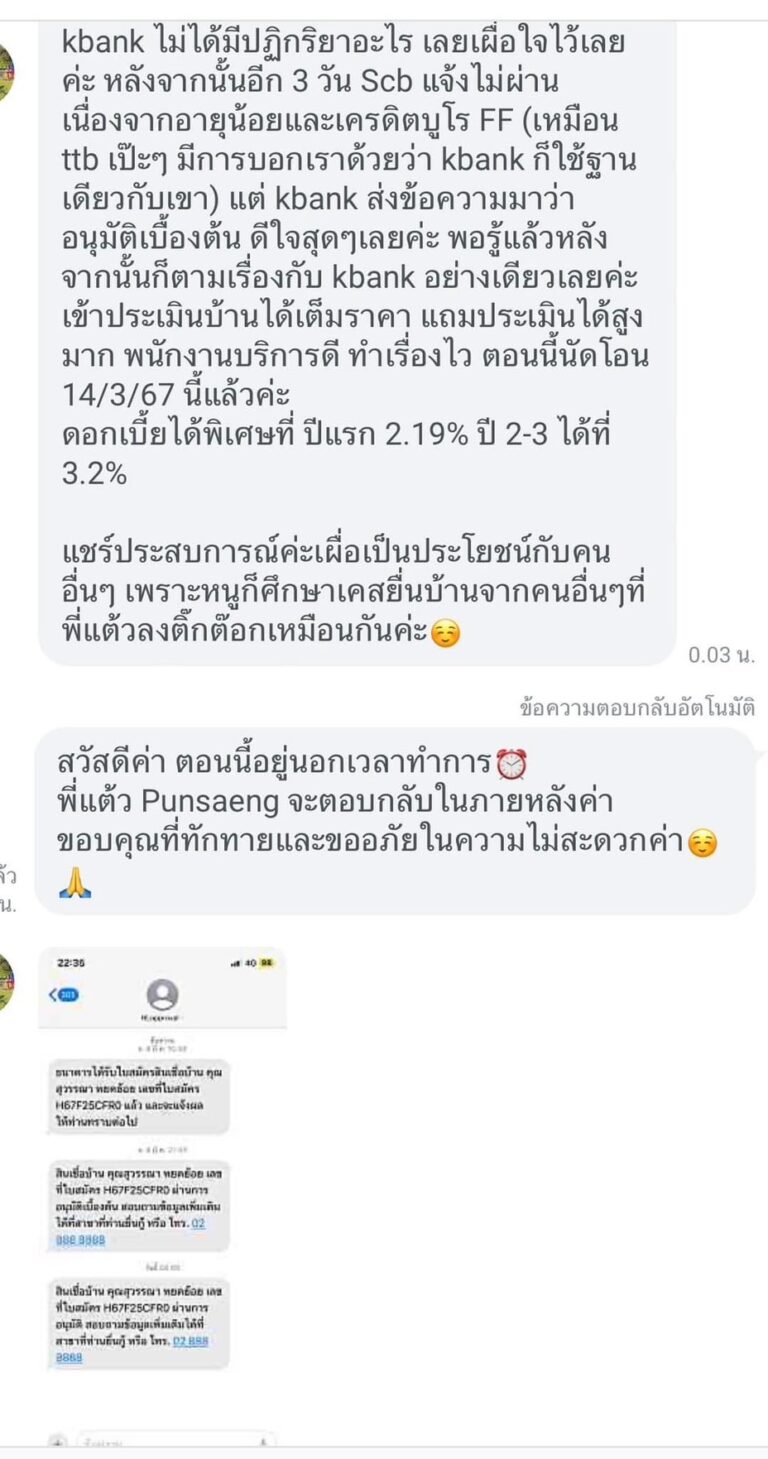

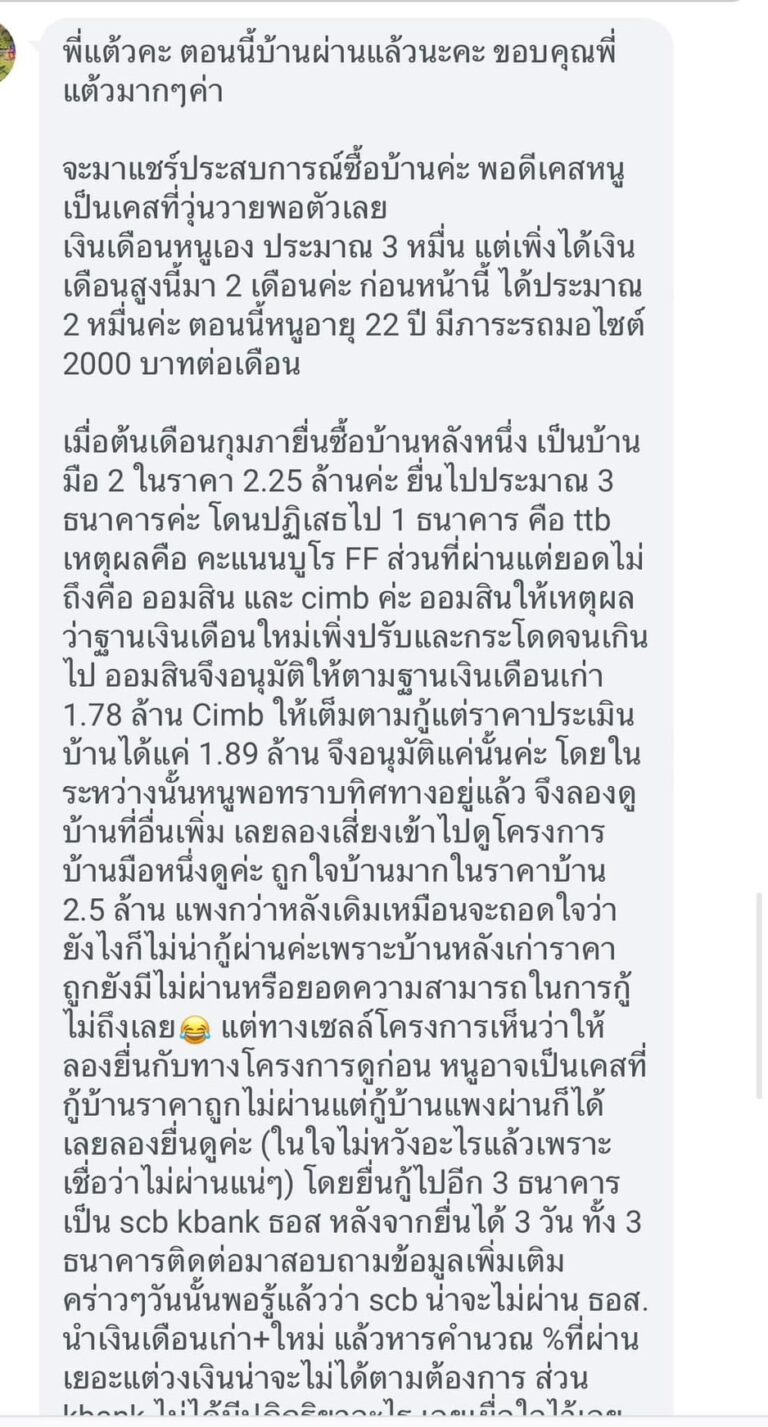

รีวิวความประทับใจจากลูกค้า